The BCG Matrix provides a structured way to manage your product portfolio by analyzing market growth and share. This guide covers the definition, the four quadrants of the BCG model, practical uses, benefits, limitations, and tips to help you allocate resources and drive business growth.

BCG Matrix Definition

The BCG Matrix, also known as the Boston Consulting Group Matrix or Growth-Share Matrix, is a tool that helps companies in reviewing their product portfolios and deciding where to invest, develop, or discontinue. It’s split into four quadrants, each representing a type of product in the company’s portfolio:

- Cash Cows: High market share but low market growth.

- Stars: High market share and high market growth.

- Question Marks: Low market share but high market growth.

- Dogs: Low market share and low market growth.

Understanding how to categorize products within the growth matrix quadrants allows businesses to make informed decisions about where to focus their efforts and resources.

What Does the BCG Matrix Evaluate: The 4 Quadrants

The Boston Consulting matrix categorizes products or business units into four distinct quadrants based on their market growth and market share. Understanding these quadrants helps with making informed strategic decisions.

Cash Cows

- Cash Cows have a high market share in low-growth or mature markets.

- They generate strong cash flow due to their established market position.

- Offer limited growth potential but remain highly profitable.

- Commonly used to finance other business units or products.

Stars

- Stars have a high market share in high-growth markets.

- They require substantial investment to sustain rapid growth and leadership.

- Generate high revenue with strong future potential.

- Can evolve into Cash Cows if growth slows but share remains high.

- Need careful management to maintain momentum and profitability.

Question Marks

- Question Marks have low market share in high-growth markets.

- They hold potential for rapid growth but face intense competition.

- Require strategic decisions on whether to invest or divest.

- Can become Stars with the right investment and execution.

- Risky but potentially rewarding depending on market dynamics.

Dogs

- Dogs have low market share in low-growth markets.

- Offer minimal growth potential and low returns.

- Often consume more resources than they generate.

- May require divestment, restructuring, or discontinuation.

- Strategic focus is on minimizing losses and reallocating resources.

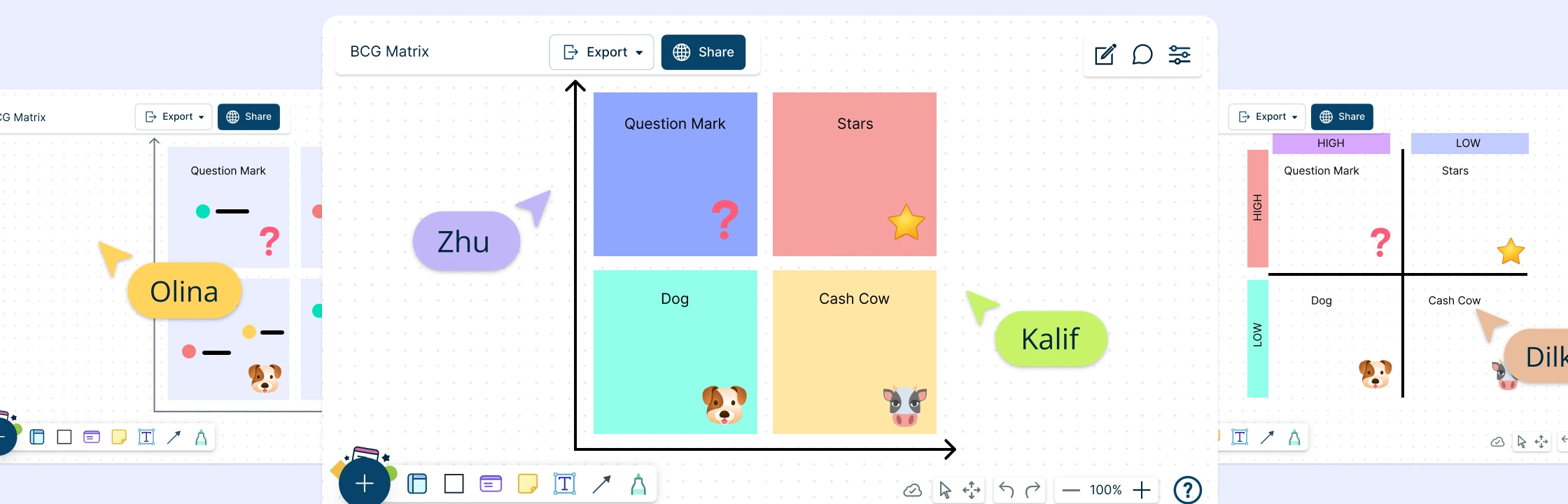

How to Use the BCG Matrix with Creately

Implementing the BCG growth matrix isn’t just about understanding where your products stand today, but also about anticipating where they could be tomorrow. Here’s how to define the BCG matrix step-by-step.

Step 1: Open the BCG Matrix Template

Use Creately’s ready-made BCG Matrix template to instantly start your analysis. The template includes all four quadrants (Stars, Cash Cows, Question Marks, Dogs) clearly labeled and spaced for easy plotting.

Step 2: Identify Business Units or Products

Start by identifying the business units or products that you want to analyze within your organization. These could be individual products, product lines, divisions, or business units, depending on the level of granularity you require for your analysis. Add shapes or sticky notes within the template to represent each business unit, product, or division. You can easily duplicate, label, and color-code them in Creately’s drag-and-drop interface.

Step 3: Gather Data

Collect relevant data on market growth rates and relative market shares for each identified business unit or product. Use linked tables, side notes, or embedded data fields in Creately to attach supporting data like market growth rates and relative market share for each product. This centralizes all relevant information within the same visual workspace.

Step 4: Plot on the Matrix

Plot each business unit or product on the growth matrix based on its market growth rate and relative market share. Assign each unit to one of the four quadrants depending on its position on the matrix. Creately’s smart grid alignment makes it easy to position elements precisely.

Step 5: Analyze Implications

Analyze the implications of the positioning of each business unit or product within the matrix. Use color indicators, comments, or connected shapes to highlight strategic implications for each product:

- Stars: Tag with “Invest” or “Grow”

- Cash Cows: Tag with “Maintain” or “Harvest”

- Question Marks: Mark for “Evaluate” or “Decision Required”

- Dogs: Flag for “Divest” or “Reassess”

Step 6: Develop Action Plans

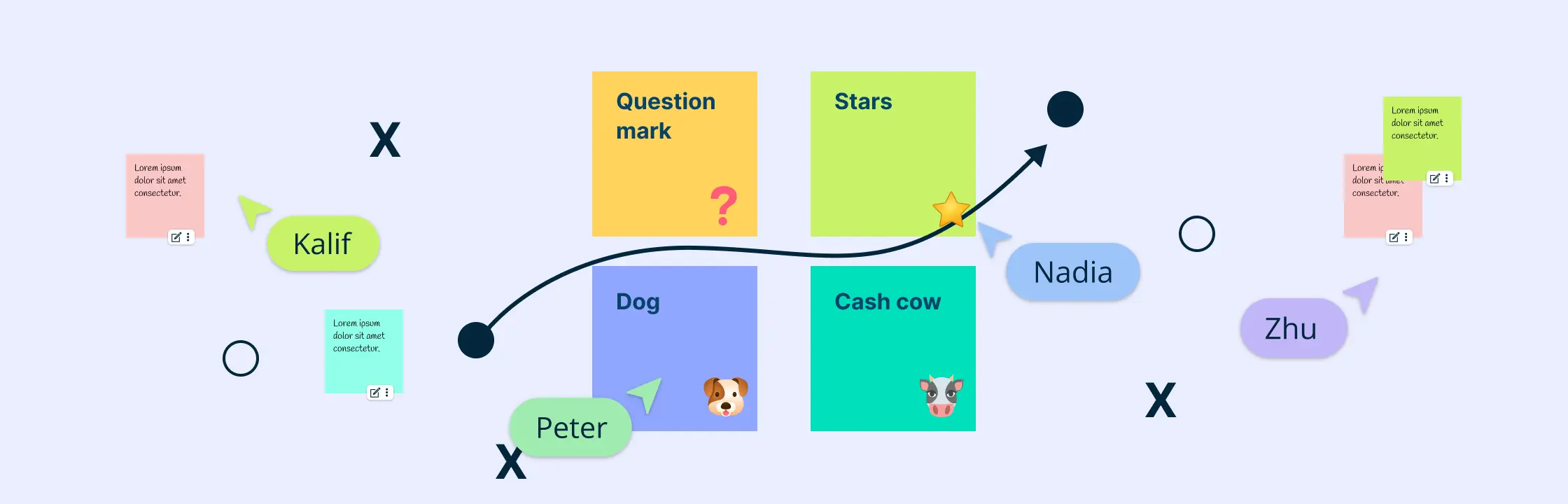

Develop action plans and strategic initiatives for each quadrant based on the analysis. Allocate resources and prioritize investments according to the strategic priorities identified for each business unit or product. Create a linked flowchart or Kanban board within the same workspace to detail action plans and assign responsibilities. Creately’s collaboration tools make it easy to work with teams in real time.

Step 7: Review and Update

Conduct regular reviews of the BCG Matrix to reflect changes in market conditions, competitive landscape, and the performance of business units or products. Use Creately’s version history to regularly review and update the matrix to ensure alignment with organizational goals and objectives.

Bonus Step: Use the AI-Powered BCG Matrix Template

Start by opening Creately’s AI BCG Matrix Template. Just describe your products or business units, and the AI will automatically generate a preliminary BCG Matrix layout for you—saving time and giving you a head start in your analysis.

Benefits and Limitations of the BCG Model

Benefits | Limitations |

Improved understanding of market dynamics: Offers clear insights into product performance and competitive positioning. | Dependence on market growth rate: Relies heavily on growth rate, which may not fully reflect market complexity or potential. |

Better resource allocation and investment decisions: Helps prioritize where to invest based on potential returns and market trends. | Oversimplifies market realities: May ignore factors like customer loyalty, brand equity, or multi-product synergies, requiring the use of additional competitive analysis frameworks. |

Supports strategic thinking and long-term planning: Provides a high-level framework to guide future decisions. | Not ideal for emerging markets: Lack of historical data makes quadrant placement difficult in new or evolving industries. |

Identifies growth opportunities: Highlights Stars and Question Marks with potential to become future market leaders. | Static and limited in fast-changing sectors: Doesn’t reflect real-time shifts in dynamic or competitive industries. |

Aids product development focus: Clarifies where to scale efforts or consider exit strategies after identifying Cash Cows and Dogs. | Ignores external factors: Doesn’t account for broader influences like economic conditions, regulatory changes, or technological disruption. |

Tips for Effective BCG Grid Analysis

Here are some tips to maximize the effectiveness of the BCG Matrix in analyzing and managing portfolio of products or business units, make informed strategic decisions, and drive sustainable growth and profitability.

- Keep the BCG matrix current by regularly reviewing and updating it to reflect changes in market conditions and business dynamics.

- Integrate the BCG with other strategic planning tools and frameworks to develop holistic strategies.

- Involve key stakeholders to ensure alignment and consensus on strategic priorities and resource allocation.

- Conduct scenario planning to anticipate future market changes and inform strategic decision-making.

- Be flexible in interpreting and applying the BCG analysis to accommodate evolving business strategies and goals.

- Translate insights from the Boston matrix into actionable strategies with clear objectives, timelines, and responsibilities.

- Foster a culture of continuous learning and improvement to refine the BCG growth matrix analysis process over time.

BCG Analysis Examples

Helpful Resources for BCG Growth Matrix

Learn how BCG analysis can be applied to optimize marketing resource allocation and tailor effective marketing strategies.

Find out the role of the BCG matrix in a company’s strategic decision-making.

Learn to identify and manage high-profit, low-investment products within a business portfolio.

FAQs about Using the BCG Model

How is market growth rate determined?

What is relative market share?

Can products move between BCG quadrants?

Is the BCG Matrix only for large companies?

Resources

Chiu, Chih-Chung, and Kuo-Sui Lin. “Rule-Based BCG Matrix for Product Portfolio Analysis.” Software Engineering, Artificial Intelligence, Networking and Parallel/Distributed Computing, vol. 850, no. 1, 2019, pp. 17–32, https://doi.org/10.1007/978-3-030-26428-4_2.

Hossain, Hanif, and Md. Abdul Kader. “An Analysis on BCG Growth Sharing Matrix.” International Journal of Contemporary Research and Review, vol. 11, no. 10, 2020. Researchgate, https://doi.org/10.15520/ijcrr.v11i10.848.