The term ‘Cash Cow Matrix’ in the BCG framework represents a cornerstone of strategic business management, offering a clear pathway to sustained financial health and strategic advantage. Understanding the cash cow strategy is crucial for businesses aiming to maximize their market potential and ensure steady revenue streams.

What is the Cash Cow Matrix

The Cash Cow Matrix is not a standalone framework, but rather refers to the Cash Cow quadrant within the widely used BCG Matrix (Boston Consulting Group Matrix). In this context, the BCG Matrix Cash Cow represents a business unit, product, or brand that is able to retain significant shares of their market and have consistently good returns. This is often the case in a mature or established industry with slow overall growth.

Characteristics of a Cash Cow Business Unit

Low Investment, High Return: Cash Cows require little investment to maintain their market position, yet they produce a high return on assets, which is vital for funding other business ventures or innovation within the company.

Steady Revenue Stream: Due to their dominant market position, cash cows provide a reliable and steady income stream, allowing businesses to plan long-term strategies with greater financial security.

Financial Stability: The surplus revenue generated by cash cows can be crucial in supporting a company’s overall financial health, providing the necessary capital to buffer against market fluctuations or invest in new opportunities.

Trusted Flagship Products: The products that fall into the Cash Cows matrix quadrant are typically well-established, flagship offerings with strong brand recognition, widespread market penetration, and loyal customer bases.

Understanding the distinction between a Cash Cow business unit and other categories in the BCG matrix, such as Stars, Question Marks, and Dogs, is essential. Unlike these other categories, cash cows are the financial pillars that support sustained growth and stability within a company.

Benefits of Understanding the Cash Cow Business Model

The BCG Matrix offers practical benefits in real-world business applications mainly by identifying Cash Cow business units and products from the rest. These include,

- Strategic clarity: It provides a clear visual representation of where each business unit stands, aiding in strategic clarity and decision-making.

- Resource allocation: Helps in prioritizing investments among different business units, focusing on potentially lucrative areas like Stars and Cash Cows.

- Long-term planning: Facilitates effective long-term planning by identifying potential growth areas and units that may require divestiture.

For comprehensive strategic analysis, integrating the BCG Matrix with other tools can be beneficial. Explore options like Grand Strategy Matrix Template for a broader strategic perspective.

Applying the Cash Cow Strategy

The strategic importance of the BCG matrix Cash Cows cannot be overstated when it comes to business growth and financial health. These business units, characterized by their ability to generate more cash than they consume, are pivotal in funding and sustaining a company’s broader strategic initiatives.

Funding and Investment Decisions

A Cash Cows business unit provides the financial backbone for a company, allowing for the allocation of capital to other areas with higher growth potential but requiring more investment.

- Strategic Reinvestment: Profits are used to fund R&D, product innovation, or marketing for emerging products.

- Support for Question Marks: Internal funding helps scale products with potential, increasing their chances of becoming future Stars.

- Risk Management: Reduces reliance on external funding when pursuing new or experimental ventures.

- Growth Flexibility: Allows exploration of new markets, technology adoption, or expansion without compromising financial stability.

Sustainability and Long-term Planning

Long-term planning and sustainability are enhanced by the stable revenue streams generated from a cash cow business unit or product.

- Operational Stability: Cash Cows provide reliable income that supports day-to-day operations, especially during economic downturns.

- Proactive Strategy: Their predictable returns enable companies to plan ahead and adapt to changing market dynamics without short-term pressure.

- Data-Driven Oversight: Tools like the BCG Matrix template help visualize business unit roles, ensuring balanced decision-making and clear accountability.

- Organizational Agility: A well-mapped portfolio helps leaders quickly reallocate resources and pivot strategies in response to market shifts.

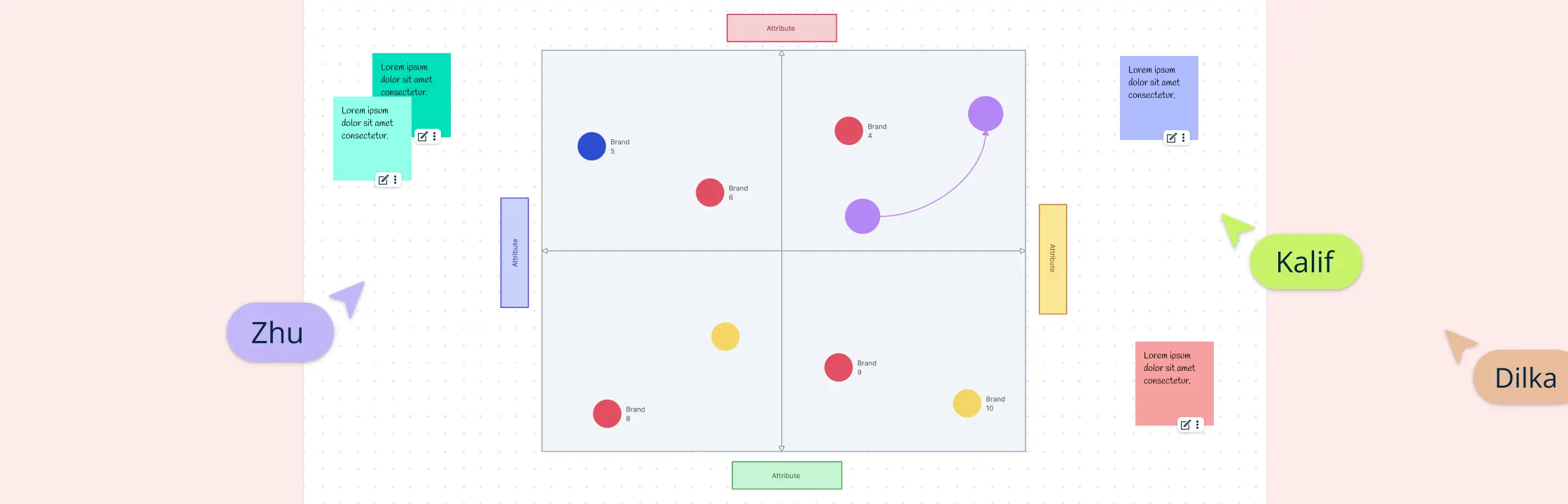

Cash Cow Matrix Templates

In the business world, understanding the practical application of concepts like the BCG matrix Cash Cow is crucial. This section delves into real-life examples of cash cows across various industries, providing insights into their management and the impact of market changes on their performance. The following are also examples of a Cash Cow in marketing since the brands require minimal promotional push yet dominate their categories and consistently deliver high ROI.

Apple – iPhone

Although originally a Star, the iPhone has matured into a Cash Cow, dominating the premium smartphone segment. With a loyal customer base and efficient supply chain, it generates massive profits with minimal marketing changes, funding Apple’s investment in new technologies like the Vision Pro.

Nestlé – Nescafé

A long-standing leader in the instant coffee market, Nescafé is a classic Cash Cow for Nestlé. It maintains strong market share in a mature industry and provides consistent revenue, allowing the company to invest in emerging segments like plant-based and wellness products.

Disney – Classic Animated Films & Merchandising

Disney’s timeless classics like The Lion King, Cinderella, and Frozen serve as Cash Cows through continuous revenue from licensing, merchandise, and re-releases. These well-established IPs generate predictable income, supporting the company’s investment in newer ventures like Disney+ and theme park expansions.

For more detailed guidance on conducting a thorough competitive analysis, which can highlight potential cash cows within your industry, refer to “How to Do a Competitive Analysis”

The BCG matrix is still a great tool for managing your Cash Cow business product portfolio. With Creately, it’s easy to bring your Cash Cow analysis to life by visualizing your portfolio with a Cash Cow diagram. You can then compare options, and fine-tune your strategy using real-time collaboration, all in one place.

More Cash Cow Model Examples

Helpful Resources for the Cash Cow Matrix

Learn what the BCG Matrix is, how to apply it, benefits, limitations, and templates.

Learn how BCG analysis can be applied to optimize marketing resource allocation and tailor effective marketing strategies.

Find out the role of the BCG matrix in a company’s strategic decision-making.

FAQs about the Cash Cow Matrix

How do you identify a Cash Cow?

Can a product move into or out of the Cash Cow matrix quadrant?

Are Cash Cows always low-growth?

Can small businesses have Cash Cows too?

Resources

Chiu, Chih-Chung, and Kuo-Sui Lin. “Rule-Based BCG Matrix for Product Portfolio Analysis.” Software Engineering, Artificial Intelligence, Networking and Parallel/Distributed Computing, vol. 850, no. 1, 2019, pp. 17–32, https://doi.org/10.1007/978-3-030-26428-4_2.

Hossain, Hanif, and Md. Abdul Kader. “An Analysis on BCG Growth Sharing Matrix.” International Journal of Contemporary Research and Review, vol. 11, no. 10, 2020. Researchgate, https://doi.org/10.15520/ijcrr.v11i10.848.