Cost-benefit analysis (CBA) is a useful approach to weighing the pros and cons before making a decision. It allows you to assess whether the benefits of a project or action justify the costs involved, helping you make choices that are more efficient and impactful. This guide will walk you through how to use cost-benefit analysis to make better decisions, providing simple steps and practical examples to help you get started. Whether you’re planning a business investment, a community project, or a personal decision, CBA can help ensure your resources are used effectively.

What Is a Cost-Benefit Analysis?

A cost-benefit analysis (CBA) is a structured process used to assess the advantages (benefits) and disadvantages (costs) of a project, decision, or investment. It helps decision-makers weigh the potential outcomes by comparing the financial, operational, and sometimes intangible impacts. By converting both costs and benefits into monetary terms, CBA allows for a direct comparison, making it easier to see whether the benefits outweigh the costs. It’s widely used in businesses, government planning, and even personal decision-making, offering a clear understanding of trade-offs to optimize value and reduce waste.

The primary goal of a CBA is to aid in selecting the most advantageous option. It goes beyond simple financial returns by accounting for indirect and long-term impacts, ensuring decision-makers consider the full scope of consequences. This holistic approach helps minimize risks and avoid unintended negative outcomes by evaluating all relevant factors, such as opportunity costs, potential risks, and intangible benefits like employee morale or brand reputation.

A well-executed cost-benefit analysis provides transparency, revealing which options offer the greatest return on investment (ROI) and aligning choices with long-term strategic goals. Whether for launching a new product, upgrading infrastructure, or choosing between two competing projects, CBA ensures informed, data-driven decisions that maximize resources and foster growth.

Key Components of the Cost-Benefit Analysis

A cost-benefit analysis (CBA) involves evaluating the total costs and benefits of a project to make informed decisions. The key components help ensure that all relevant factors are considered.

- Project scope: Clearly define what you’re evaluating, including the goals and expected outcomes of the project.

- Costs: Identify direct, indirect, opportunity, and intangible costs. These can range from upfront expenses to potential trade-offs.

- Benefits: List the measurable and intangible benefits, such as increased revenue or improved customer satisfaction.

- Monetary valuation: Assign monetary values to both costs and benefits for easy comparison.

- Comparison and evaluation: Analyze the data to determine whether the benefits outweigh the costs, using financial metrics like net benefit or benefit-cost ratio.

How to Do a Cost-Benefit Analysis

Follow these steps to conduct a thorough cost-benefit analysis, allowing you to make more informed and effective decisions.

Step 1: Build a framework

Start by building a clear framework for your cost-benefit analysis to guide the process. This involves defining the project or decision and setting precise objectives. Establish what will be included, such as specific costs, benefits, and timeframes, and what will be excluded. For example, if you’re evaluating opening a new restaurant, decide whether the analysis will focus on short-term operational costs, long-term strategic benefits like brand expansion, or a combination of both. Identifying the project’s scope upfront helps avoid overlooking key factors and ensures a focused analysis.

Next, identify stakeholders who need to be involved and the data sources you’ll need to gather accurate information. Specify financial, operational, or market data, and decide which metrics are most relevant for your analysis.

Step 2: Define the project scope

The first step in a cost-benefit analysis is to clearly define what you are evaluating. This means identifying the project, decision, or change you’re considering. For example, if you’re evaluating whether to open a new restaurant location, outline the goals such as increasing revenue, the target market for the new location, and the resources needed. Be clear about the boundaries, such as the specific costs and benefits that will be included in your analysis to focus only on relevant aspects of the project.

Step 3: Identify costs and benefits

Gather a comprehensive list of all potential costs and benefits associated with the project. Be thorough in identifying everything that will impact the project, either positively or negatively. This ensures that the analysis is accurate and that you’re considering all factors that could influence the final decision.

For example, in the case of opening a new restaurant, your list might include:

Types of costs

- Direct costs: These are the obvious expenses necessary for the project. For example, this may include the cost of leasing the building, buying kitchen equipment, and hiring staff. For example, the monthly rent might be $5,000, and hiring and training staff could cost $20,000 upfront.

- Indirect costs: These are additional costs that aren’t directly tied to the project but still impact it. For instance, overhead costs such as utilities, rent, and administrative salaries should be included here(utilities could add $1,500 per month, and insurance might cost $1,000 annually for the restaurant.) Think about all the support functions that contribute to the project.

- Opportunity costs: Consider what you are giving up by choosing this project over another. For example, opening a new location might mean you’re delaying investments in expanding the menu at your current restaurant, which could increase sales by 10%.

- Intangible costs: These can be harder to measure but are still important. They might include factors like employee dissatisfaction due to increased workload or negative environmental impacts that could affect your brand reputation.

Types of benefits

- Direct benefits: Look for tangible, measurable gains that the project will bring, such as increased sales at the new location (e.g., $50,000 per month in revenue) and lower supply costs from bulk purchasing might directly impact your profits. Quantifying these benefits helps create a clearer financial picture.

- Indirect benefits: Think about the additional positive impacts that might not have a direct financial correlation, such as improved customer loyalty, enhanced brand recognition, or better market positioning. These can significantly affect long-term success.

- Intangible benefits: These benefits may include factors like improved employee morale or customer satisfaction, which, while difficult to quantify, can lead to enhanced productivity and loyalty.

- Long-term benefits: Consider the ongoing advantages that will accumulate over time. This might involve sustained cost savings, continuous revenue growth, or the potential to capture a larger market share in the future.

By thoroughly identifying and categorizing these costs and benefits, you can ensure a comprehensive analysis that aids in making informed decisions. This approach allows for a more nuanced understanding of the project’s impact, ultimately supporting a well-rounded evaluation.

Step 4: Assign monetary values

In this step, you convert all the identified costs and benefits into monetary terms. This is essential for comparing them on an equal basis.

Assigning costs

- Direct costs: Quantify expenses like labor, materials, and equipment. For example, if you need to purchase new restaurant equipment, calculate the total cost of stoves, refrigerators, etc., which might total $50,000.

- Indirect costs: Estimate expenses that aren’t directly tied to the project, like utilities, administrative overhead, or additional employee training (for things like rent or insurance, if rent is $5,000 per month, over a year that totals $60,000). Use averages or percentages if exact figures aren’t available.

- Opportunity costs: These represent the potential gains you miss by choosing this project over another. For instance, if investing in a new menu could bring an additional $30,000 in profits annually, that’s what you miss by choosing the new location.

Assigning benefits

- Direct benefits: These are straightforward to calculate, such as increased sales or reduced operating costs. If the new location is expected to generate $600,000 annually, that’s the direct benefit.

- Indirect benefits: Although these are harder to quantify, it’s possible to estimate their monetary value. For instance, if brand loyalty increases sales by 5% across all locations, this could lead to an additional $100,000 annually.

- Intangible benefits: These include things like customer satisfaction or employee morale. You can estimate the financial impact using surveys, customer lifetime value (CLV) models, or calculating the potential for repeat business.

- Long-term benefits: Calculate the future value of ongoing benefits such as cost savings or revenue growth. Use financial metrics like Net Present Value (NPV) to account for how the value of money changes over time.

This process helps quantify every aspect of the analysis, making it easier to compare costs and benefits clearly.

Step 5: Comparing costs and benefits

This step involves directly comparing the monetary values assigned to the costs and benefits of the project to determine whether the benefits outweigh the costs.

- Calculate net benefit: Subtract the total costs from the total benefits to get the net benefit. If the result is positive, the project is generally considered beneficial. If your new restaurant generates $600,000 annually but costs $500,000 in setup and operational costs, the net benefit is $100,000.

- Use financial metrics: For more detailed analysis, apply methods like Net Present Value (NPV) or Benefit-Cost Ratio (BCR). NPV accounts for the time value of money, comparing future costs and benefits in today’s terms. BCR divides the total benefits by the total costs, with values greater than 1 indicating a good investment.

- Consider time frames: If costs are incurred upfront but benefits occur over time, ensure you account for the differences in time through discounting techniques, so you compare costs and benefits in equivalent terms.

- Evaluate risk and uncertainty: Consider any uncertainties or risks associated with the project. Opening a restaurant might carry risks such as unexpected regulatory costs or lower-than-expected sales, which should be factored into the final decision. For example, a slow tourist season could reduce expected revenue by 20%. Sometimes, costs and benefits are estimates, and adjustments should be made to account for potential fluctuations or unforeseen events.

- Payback period: This method calculates how long it will take for the benefits to cover the costs. For example, if a restaurant investment is $500,000 and it generates $100,000 annually, the payback period is five years.

- Internal Rate of Return (IRR): This is the discount rate that makes the net present value (NPV) of a project zero. A higher IRR means a more profitable project.

- Sensitivity analysis: This examines how changes in assumptions (like costs or sales) affect the outcome, helping evaluate risk under different scenarios.

This step allows you to see whether the project is financially viable, and helps you weigh the potential gains against the resources required to execute it. By comparing these values, decision-makers can confidently decide whether the project is worth pursuing.

Step 6: Make a recommendation based on the findings

After comparing the costs and benefits, you need to make a clear recommendation. This decision should be based on whether the benefits outweigh the costs and whether the project aligns with the organization’s goals.

If the net benefit is positive, recommend proceeding with the project. If the costs outweigh the benefits, suggest canceling or revising the plan. Consider any risks or uncertainties when making your recommendation. Include additional insights, like the long-term sustainability or potential challenges, to guide decision-makers.

For example, if opening the new restaurant generates a net benefit of $100,000 annually with a positive NPV and acceptable risks, suggest moving forward with the project. On the other hand, if the costs are too high or the risks are too uncertain, recommend revising the plan or exploring other opportunities.

Ultimately, the goal is to offer a well-supported, data-driven recommendation that maximizes value.

Cost Benfit Analysis Templates

Here are cost-benefit analysis templates to help you streamline your evaluation process. These templates are customizable and designed to guide you in organizing costs, benefits, risks, and financial metrics for effective decision-making.

Pros and Cons of Cost-Benefit Analysis

When considering the use of cost-benefit analysis (CBA), it’s important to weigh its advantages and disadvantages. While CBA offers valuable insights for decision-making, it also presents challenges that can impact the analysis’s accuracy and effectiveness.

Advantages of Cost-Benefit Analysis

- Informed decision-making: By providing quantitative data on costs and benefits, CBA allows stakeholders to make decisions based on concrete information rather than intuition. This clarity helps reduce uncertainty and promotes confidence in the choices being made.

- Financial clarity: CBA translates all costs and benefits into monetary terms, enabling straightforward comparisons. This approach helps businesses and organizations evaluate the financial feasibility of different projects, ensuring they choose the most beneficial options.

- Identifies trade-offs: CBA highlights the opportunity costs associated with various choices, showing what is sacrificed when one project is selected over another. Understanding these trade-offs helps stakeholders assess the true value of their options.

- Risk assessment: CBA encourages a thorough evaluation of potential risks and uncertainties linked to a project. By analyzing these factors, organizations can make more informed decisions and better prepare for possible challenges.

- Structured approach: The systematic nature of CBA provides a clear framework for evaluating projects. This structure ensures that all relevant factors are considered, making the analysis comprehensive and reducing the chances of overlooking critical aspects.

Limitations of Cost-Benefit Analysis

- Complexity: Accurately quantifying intangible benefits or costs can be challenging, as they may not have a clear monetary value. This complexity can lead to oversimplification or omission of significant factors that affect the project’s overall viability.

- Assumptions: CBA often relies on assumptions about future costs and benefits, which may not hold true. These assumptions can introduce inaccuracies into the analysis, potentially leading to misguided decisions.

- Short-term focus: CBA may prioritize immediate costs and benefits, overshadowing long-term impacts. This short-sightedness can result in decisions that seem profitable in the short term but may have detrimental effects in the future.

- Subjectivity: The identification and valuation of costs and benefits can be influenced by personal biases or preferences. This subjectivity can lead to inconsistent analyses, as different stakeholders may weigh factors differently based on their perspectives.

- Data availability: Conducting a thorough CBA requires accurate and reliable data. In some cases, this information may not be readily available, making it difficult to perform a comprehensive analysis and potentially compromising the validity of the findings.

When Should You Use a Cost Benefit Analysis

Cost-benefit analysis is a versatile tool that can guide decision-making in various scenarios. Below are situations where it proves most useful:

- Evaluating large investments: Use CBA when considering significant expenditures, such as purchasing new equipment or launching a major project, to determine if the potential returns justify the costs.

- Assessing new projects: Apply CBA to weigh the pros and cons of a new initiative, helping you understand its financial implications before moving forward.

- Analyzing operational changes: When contemplating changes in processes or services, CBA helps identify if the benefits outweigh the costs associated with implementation.

- Prioritizing competing initiatives: Use CBA to rank different projects or proposals based on their potential value, ensuring resources are allocated effectively.

- Justifying funding requests: CBA can support funding applications by providing a clear financial rationale, demonstrating how the proposed project will generate more benefits than costs.

- Evaluating new business ventures: When considering entering a new market or launching a new product, use cost-benefit analysis to assess potential profits versus the investments required, such as marketing, production, and operational costs.

- Determining environmental or policy decisions: Governments or organizations often use cost-benefit analysis when evaluating policies, such as environmental regulations or infrastructure projects, to balance financial costs with societal benefits, like public health improvements or reduced emissions.

- Budget allocation and resource planning: When managing limited resources, cost-benefit analysis helps prioritize where to allocate funding or manpower. For example, it aids in choosing between competing projects based on which offers the highest return for the least cost.

Cost-Benefit Analysis Examples

This section provides simple examples of how cost-benefit analysis is used in real situations. Each example demonstrates the process of identifying costs and benefits, assigning monetary values, and evaluating whether a project is worth pursuing. By looking at these scenarios, you’ll better understand how cost-benefit analysis helps businesses and organizations make smart decisions.

New product launch

A tech company is considering launching a new smartwatch. They estimate production, marketing, and distribution costs at $200,000. The projected sales over the first year are $500,000, leading to a gross profit of $300,000. After factoring in ongoing costs, such as customer support and warranty services, they still see a net benefit of $250,000. This positive outcome indicates a strong case for proceeding with the launch.

Building a new facility

A retail business plans to construct a new warehouse to streamline operations. The total estimated cost for land, construction, and equipment is $1 million. They expect to save $150,000 annually on shipping costs and reduce delivery times, leading to increased customer satisfaction and repeat business. Over 10 years, these savings would accumulate to $1.5 million. The analysis shows a clear financial advantage, making it a sensible investment.

Upgrading technology

A school district is evaluating an upgrade of its computer systems to improve educational outcomes. The upfront cost for new equipment and teacher training is $50,000. With improved technology, they anticipate enhanced student performance, which could attract more students and increase funding by an estimated $100,000 over five years. This analysis supports the investment by demonstrating significant long-term benefits relative to costs.

Environmental policy

A city government considers implementing a citywide recycling program. The initial cost to set up the program, including bins and educational campaigns, is estimated at $200,000. However, the anticipated benefits—such as reduced landfill fees and environmental health improvements—are valued at $500,000 over a 10-year period. This positive net benefit makes a compelling argument for adopting the program, aligning with the city’s sustainability goals.

Employee training program

A company decides to invest $20,000 in a comprehensive training program for its sales team. They project that the training will lead to a 15% increase in productivity, translating to an additional $50,000 in revenue annually. Over three years, this results in a total benefit of $150,000. The cost-benefit analysis clearly illustrates that the investment will yield significant returns, making it a strategic decision to enhance employee skills and performance.

Templates to Help with Your Cost-Benefit Analysis

Here are templates that can help streamline your cost-benefit analysis process. These templates will help structure your cost-benefit analysis, allowing for a more comprehensive and organized evaluation of your decision.

Cost breakdown template

This organizes all types of costs—direct (like equipment and labor), indirect (overhead or utilities), opportunity costs, and intangible costs (e.g., environmental impact). It ensures every financial aspect is considered.

RACI matrix template

This clarifies roles and responsibilities by listing who is Responsible, Accountable, Consulted, and Informed for each task in your project, ensuring clear communication during the analysis.

Project budget template

Breaks down all project expenses, helping to manage costs by tracking actual spending against forecasts, essential for accurate cost assessment.

Project risk register template

A tool to document potential risks, their likelihood, and impact, and detail mitigation strategies to ensure the project stays on track despite uncertainties. Helps identify potential risks (e.g., market changes, regulatory costs) and assigns likelihood and impact scores, ensuring risk is integrated into your decision-making.

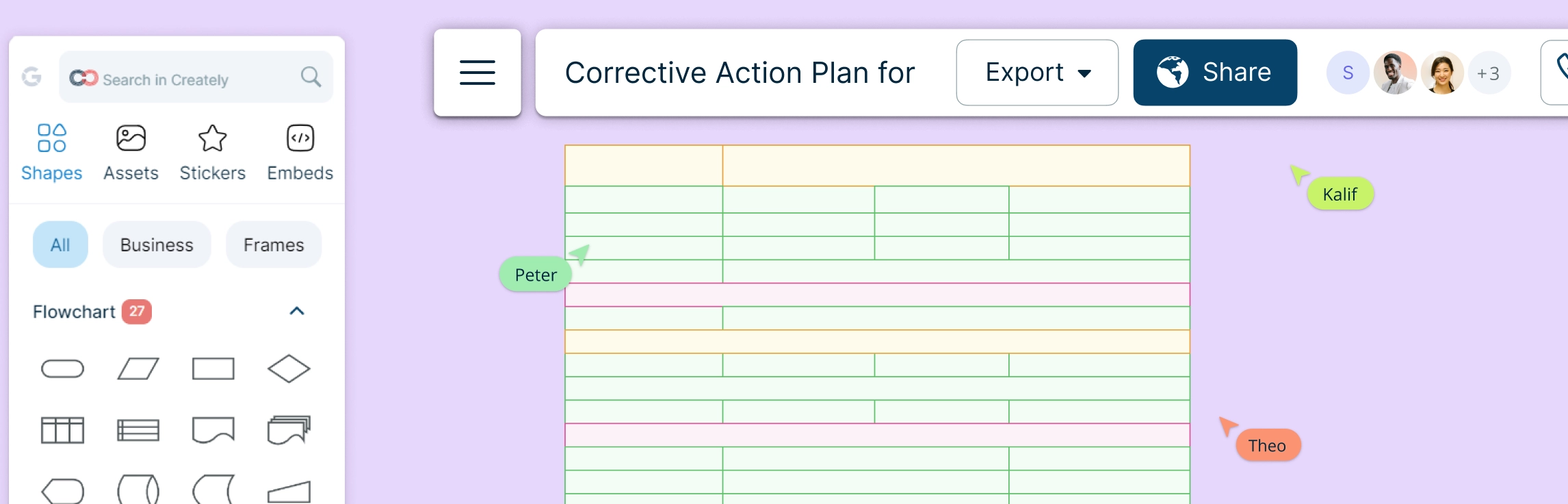

Simplifying Your Cost-Benefit Analysis with Creately

Creately provides a variety of features to enhance your cost-benefit analysis process. With visual collaboration tools, your team can work together in real time to create and edit diagrams. The platform offers customizable templates specifically for cost-benefit analysis, enabling efficient organization. Its drag-and-drop interface allows easy addition of shapes and connectors, while seamless data integration ensures accurate figures are imported directly. You can work with team members in real time to create and edit diagrams, ensuring everyone’s input is considered. You can add comments for feedback, export your analysis in multiple formats, and store projects in the cloud for easy access. These features streamline decision-making and improve team communication.

Wrapping up

In conclusion, a cost-benefit analysis is a valuable tool for making informed decisions. By clearly defining project scopes, identifying costs and benefits, assigning monetary values, comparing these figures, and making recommendations, you can evaluate the feasibility and potential success of a project. This structured approach not only aids in understanding the financial implications but also helps ensure that resources are used effectively. By carefully considering both tangible and intangible factors, you can make decisions that align with your organization’s goals and long-term success.

References

Stobierski, T. (2019). How to Do a Cost-Benefit Analysis. [online] Harvard Business School Online. Available at: https://online.hbs.edu/blog/post/cost-benefit-analysis.